G20 Analysis

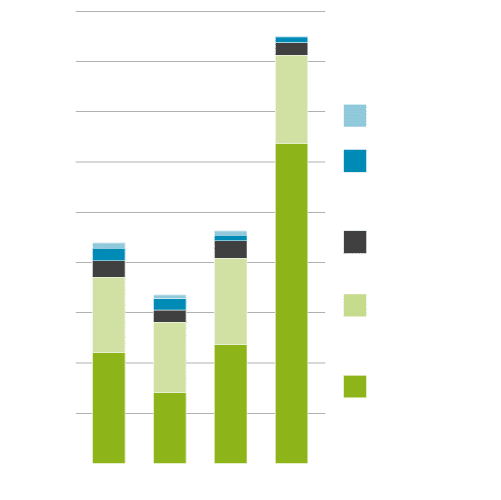

The Energy Policy Tracker covers the 2020-2021 period with data on COVID-19 government policy responses from a climate and energy perspective. Our analysis provides a detailed overview of the public finance flows as determined by recovery packages across the G20. Filter by country, energy type, finance mechanisms, and other categories to see, at a glance, what types of measures countries are implementing to tackle the crisis and what is shaping our future energy system.

Explore the dataInequality and Poverty Dashboard

Different types of energy policies have varying impacts on within-country inequalities and poverty. Assessing those impacts and who may be adversely impacted is essential to achieving a just energy transition. The analysis in the Inequality and Poverty Dashboard supports this by providing an overview of the state of play of inequality and poverty for 30 countries covered in the Energy Policy Tracker, how different types of energy policies may contribute to decrease or exacerbate inequality and poverty and what types of complementary measures can be put in place to mitigate potential negative social impacts.

View Dashboard

Why it matters

G20 governments have pledged to inject trillions of dollars into the global economy to counteract the health, social, and financial shocks caused by the COVID-19 crisis. This large-scale stimulus spending will shape the global economy for decades to come. These decisions could trigger unbearable climate disasters or create a resilient and safe economy powered by clean energy.

Why it mattersLatest policies

| Country | Jurisdiction | Category | Policy name | Sector | Energy Type | Mechanism | Value committed, USD | Date of announcement | Stage | Legislation and Endorsing Agency | Arm of Government | Primary and secondary stated objective of the policy | Date of entry into force | Implemented repeal date, if any | Value committed, national currency | Value disbursed, national currency | Value disbursed, USD: | Policy background | Links to official sources | Links to additional sources | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Canada | National | Fossil unconditional | Support provided by Export Development Canada to oil and gas in 2021 | Resources | Oil and gas | Other hybrid support measures | 3839671886.6518 | 31/12/2021 | Several energy stages | EDC | Public finance institution | Increase the competitiveness of Canada's oil and gas sector | 5149000000 | This amount of funding represents the total support Export Development Canada (EDC), Canada's export credit agency, provides to the domestic fossil fuel industry (specifically to oil and gas) for the 2021 period. | https://www.edc.ca/en/about-us/corporate/disclosure/reporting-transactions/canadian-industry-sub-sector-2021.html |

||||||

| Italy | National | Clean unconditional | Energy efficiency incentives (2022 Budget) | Buildings | Energy efficiency | Budget or off-budget transfer ... | 9132420.0913242 | 30/12/2021 | Energy efficiency | Italian Government (2022 Budget - Law n. 234/2021 Article 1 Paragraph 514) | Government | To guarantee the achievement of national energy efficiency targets | 30/12/2021 | 8000000 | 8000000 | 9132420.0913242 | The National Fund for energy efficiency is boosted to 8 million euros per year, starting from 2022. The incentives include disbursement of loans, part of which are non-repayable. The incentive supports interventions aimed at guaranteeing the achievement of national energy efficiency targets. | https://def.finanze.it/DocTribFrontend/getAttoNormativoDetail.do?ACTION=getArticolo&id=%7B94E01245-17B0-4652-809D-BD8DB6DE9CDC%7D&codiceOrdinamento=300010000514000&articolo=Articolo%201-com514 (Accessed 18 February 2022) |

|||

| Ukraine | National | Clean unconditional | National Action Plan on Energy Efficiency until 2030 | Multiple sectors | Energy efficiency | Uncategorized | 29/12/2021 | Energy efficiency | N/a | Government | To establish a national energy efficiency target and measures to achieve it in line with European approaches to Directive 2012/27/EU "On Energy Efficiency" | 29/12/2021 | On December 29, 2021, the Government approved the National Action Plan for Energy Efficiency until 2030. At the same time, a 3-year action plan for its implementation in 2021-2023 was approved. | https://www.kmu.gov.ua/news/uryad-shvaliv-nacionalnij-plan-dij-z-energoefektivnosti-na-period-do-2030-roku |

https://ua-energy.org/uk/posts/uriad-skhvalyv-natsplan-dii-z-enerhoefektyvnosti-na-period-do-2030-roku |

||||||

| Spain | Galicia | Other energy | Emergency social aid to avoid power cuts to severely vulnerable consumers at risk of social exclusio... | Power generation | Multiple energy types | Budget or off-budget transfer ... | 1484018.2648402 | 29/12/2021 | Energy use (all energy types, consumption in transport, household use, buildings etc) | ORDER of December 29, 2020 | Government | To ensure continued access to energy supply electricity for vulnerable families. | 21/01/2022 | 1300000 | The amount of the electricity bill has increased considerably in recent years, mainly due to the increase in fixed costs derived from the tariff deficit that are included in the electricity bill, and that cannot be reduced through lower energy consumption. This fact, together with the current economic context, causes that some Galician families do not have the minimum economic possibilities to pay the electricity bill. Thus, the Galician government wants to carry out actions aimed at alleviating these difficulties for the most vulnerable Galician families by designing an aid program that allows them to pay electricity bills, in order to ensure continued access to energy supply electricity. In addition, these aids arre created within the framework of the new state regulation established in Royal Decree 897/2017, of October 6, which regulates the figure of the vulnerable consumer, the social bonus and other protection measures for consumers. domestic electrical energy. The eligible expenses will be 50% of the amount of the electricity bills, with a maximum amount of between €300 and €450 per year depending on the characteristics of the family unit. | https://sede.xunta.gal/detalle-procedemento?codtram=IN414D&ano=2021&numpub=1 (Accessed 15 Jan 2022) https://www.xunta.gal/dog/Publicados/2021/20210120/AnuncioG0596-301220-0001_es.html (Accessed 15 Jan 2022) |

|||||

| Ukraine | National | Fossil unconditional | The Ministry of Energy transferred funds for the payment of wages to employees of state mines | Resources | Coal | Budget or off-budget transfer ... | 14537956.304541 | 28/12/2021 | Exploration or production or processing or storage or transportation | Cabinet of Ministers Resolution # № 1733-р of 28 December 2021 | Government | To repay wage arrears to miners | 28/12/2021 | 392000000 | The Cabinet of Ministers has allocated UAH 300 million to the Ministry of Energy from the reserve fund of the state budget to pay arrears of wages to employees of state-owned coal mining companies. The Ministry of Finance made these expenditures on a non-refundable basis at the expense of the reserve fund of the state budget. In addition, on December 24, the miners of the state mines received UAH 92 million for the payment of wages from the budget savings of the Ministry of Energy and the corresponding redistribution of expenditures from other budget programs. | https://www.kmu.gov.ua/npas/pro-vidilennya-koshtiv-z-rezervnogo-fondu-derzhavnogo-byudzhetu-i281221-1733 |

http://mpe.kmu.gov.ua/minugol/control/uk/publish/article?art_id=245615997&cat_id=35109 |

Argentina

Argentina Australia

Australia Bangladesh

Bangladesh Brazil

Brazil Canada

Canada Chile

Chile China

China Colombia

Colombia Egypt

Egypt Estonia

Estonia European Institutions

European Institutions Finland

Finland France

France Germany

Germany India

India Indonesia

Indonesia Italy

Italy Japan

Japan Kenya

Kenya Mexico

Mexico New Zealand

New Zealand Nigeria

Nigeria Norway

Norway Peru

Peru Philippines

Philippines Poland

Poland Republic of Korea

Republic of Korea Russia

Russia Saudi Arabia

Saudi Arabia South Africa

South Africa Spain

Spain Sweden

Sweden The Netherlands

The Netherlands Turkey

Turkey Ukraine

Ukraine United Kingdom

United Kingdom United States

United States Vietnam

Vietnam